Silicon Labs CEO Plots Slow, Steady IoT Strategy

AUSTIN, Texas — “IoT is in a bit of a trough right now,” Tyson Tuttle, CEO of Silicon Labs, told EE Times, just as he was leaving the ballroom where he delivered a keynote entitled “Accelerating the IoT” to a packed audience at the Design Automation Conference.

With a market anxious about the insecurities of IoT and hobbled by connected devices that remain both hard to design and expensive, there is indeed a whiff of IoT backlash in the air. Tuttle also concedes that IoT isn’t among the “new things” that ordinary people talk about these days.

Tyson Tuttle, Silicon Labs CEO (photo: Silicon Labs)

Tyson Tuttle, Silicon Labs CEO (photo: Silicon Labs)

Nevertheless, the CEO sees this lull as an opportunity for Silicon Labs.

Tuttle made two points abundantly clear during his keynote and a subsequent one-on-one interview with EE Times: Silicon Labs is in it — the IoT market — for the long haul, while striving to deliver the “simplicity” and “security” that will entice system designers to add connectivity to their products.

But he also warned: “It will take multiple decades for IoT to play out.”

Let that sink in for a moment.

Tuttle isn’t discussing what IoT can do to Silicon Labs’ bottom line next quarter or next year. His long view on IoT is allowing him to ponder societal changes IoT could bring in 2020, 2030 and beyond.

IoT impact on system designers

In fact, during his keynote, Tuttle didn’t dwell on IoT as a market opportunity with billions of connected devices primed for exploitation by Silicon Labs. Of course, there is that.

Instead, he spoke more about the impact of IoT on system designers. “When you design your next product, I don’t know how you can do it without thinking about connectivity,” he said.

“Products remain static if they aren’t connected,” Tuttle said. With connectivity, products become dynamic, able to add new features, upgrade functions and enhance security. Systems can become end nodes capable of monitoring and tracking. Connectivity can add value to products, he noted. “Without it, your new product will race to the bottom.”

Of course, the early days of IoT have focused on the home market, with products like connected washing machines and refrigerators. Inevitably, this begs the question: “What for?”

Despite such skepticism, system designers are adding connectivity to “old-school” products, said Tuttle.

Consider, for example, power tools. Picture a construction site. Workers arriving onsite activate their Bluetooth-connected power tools with an app on their own smartphones.

Why?

It sounds like an extra step, but smartphone connectivity can prevent the theft of tools, said Tuttle. Anyone without the code can’t use the tool.

More important, connected power tools enable asset tracking. Builders will know who used which power tools where, when and how — even recording torque level. Such a tracking mechanism makes it easy for builders to compile a report required later by inspectors.

Insurance companies also benefit. Assume power tools were used to install a solar panel. A few months later, one of the panels cracks. Was this flaw triggered by an overtightened screw during construction? The insurance company might find the answer by calling up data from the screwdriver.

In a hot city like Austin, consumers are encouraged to “pre-cool” their homes before they leave work. Is this for their comfort? Not necessarily, said Tuttle. “It helps utility companies reduce peak power consumption.”

Connectivity also enhances health devices. By adding connectivity to, for example, an inhaler, it’s possible to monitor where its user went and every use of the device. This is data vital to preventive care.

Connectivity is essential for enabling big data, artificial intelligence and deep learning. “IoT is an embodiment of all those new things we’re all talking about,” said Tuttle.

Tuttle believes connectivity will disrupt healthcare, retail, transportation and energy. “IoT is the biggest opportunity of our lifetime” for society, he asserted.

Platform play

The diversity of IoT markets and applications presents a particular challenge to chip suppliers like Silicon Labs.

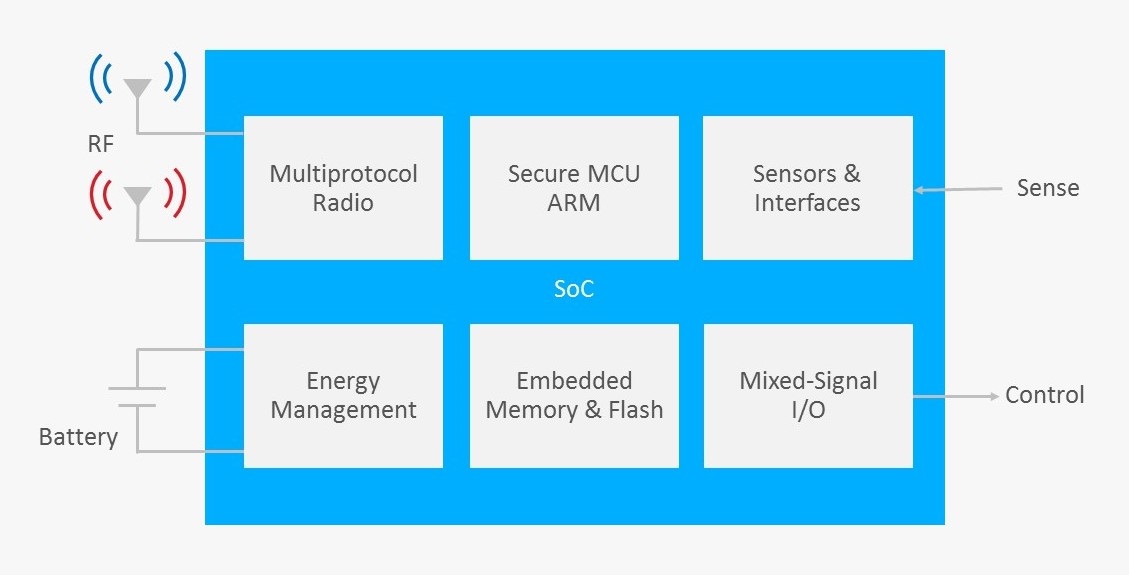

Facing tens of thousands of customers, how can you support them all, and scale your IoT chip business? The only way it is “to build a platform around the IoT SoC,” from which multiple products can be spawned, explained Tuttle. “Simplicity of design is the key to support for our customers.”

Lowering the costs of connectivity and security is also essential. A design must hit the right price point fast enough to trigger a “network effect,” when more apps emerge, volume production starts and the benefits of connectivity expand.

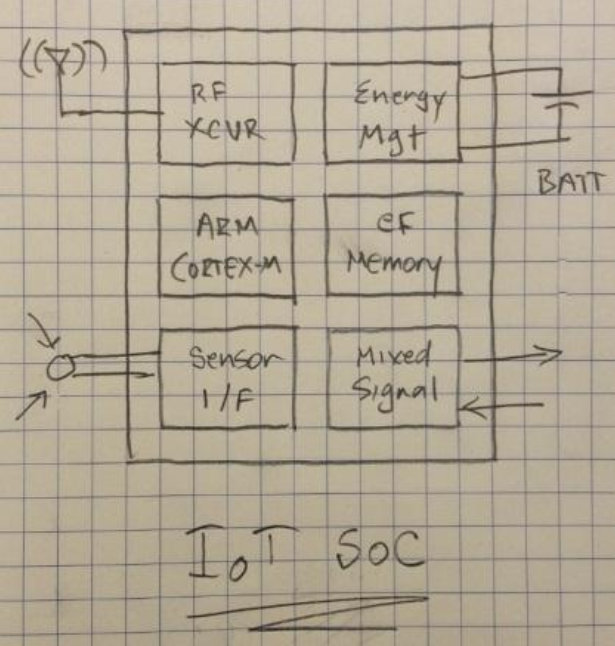

Three years ago, when this reporter met with Tuttle in Shanghai, he showed a block diagram of the IoT SoC. It was not a real product — just a scribbled on a sheet of engineering paper.

In his keynote at DAC this week, Tuttle showed a fancier version of the IoT SoC block diagram on a big screen. Key blocks are all intact as originally envisioned. For Silicon Labs, the platform approach was imperative so that the company’s components “won’t get commoditized, bundled out and integrated out.”

The IoT SoC (Source: Silicon Labs)

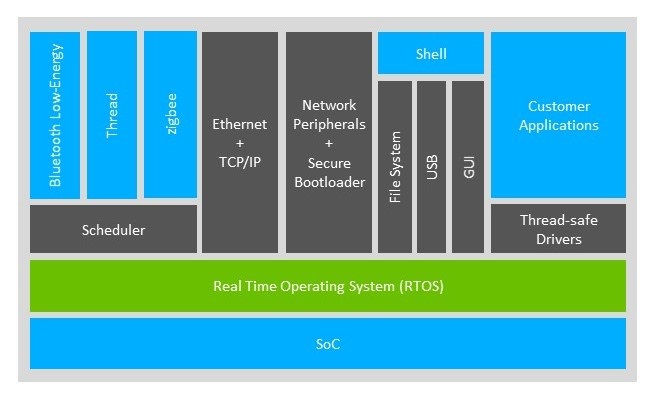

The IoT SoC (Source: Silicon Labs)Silicon Labs concentrated its resources over the last few years on a software stack that connects the IoT SoC all the way to the Cloud. Integrated in its layers are a lightweight RTOS, support for dynamic multi-protocols and enhanced security, according to Silicon Labs.

Asked to compare Silicon Labs with rivals on the IoT semiconductor market, Tuttle said, “I think we’ve taken a much more holistic approach.”

Companies like Texas Instruments and Broadcom (whose IoT team was acquired by Cypress Semiconductor) might have gone for immediate profit, he observed.

“But I've always believed the software framework needs to be there to eventually enable the IoT market. In the end, layers of additional software will differentiate our IoT solutions from others,” he said.

Tuttle recalled 2010, the year he became CTO, as a seminal year for Silicon Labs’ IoT strategy. “We took a fundamental shift by allocating two thirds of our R&D resources to IoT,” he said.

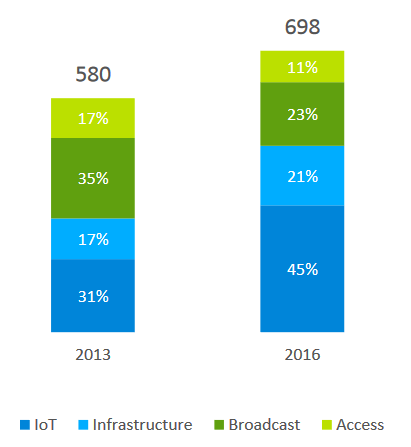

He added, “We decided to take a big position on three things. IoT was one of them.” Two other areas of focus were a cloud/infrastructure business where the company’s timing and clock generator chips go, and a green energy sector where its high voltage power and isolation technologies can be exploited.

Bold but methodical

Since then, Silicon Labs has taken a bold, but methodical approach to expanding the company’s IoT portfolio in software and hardware. Tuttle burned a lot of his energy articulating his vision of IoT and persuading his engineering team, the board, management, CFO and investors to buy in.

Tuttle had to wheedle more money for acquisitions and more time for his team to develop software skills. Because of its inherent risk and uncertain payback, this amounted to a harder sell than asking management for more money to pitch existing chips to the contemporary IoT market.

Tyson Tuttle at the DAC (photo: Silicon Labs)

Tyson Tuttle at the DAC (photo: Silicon Labs)The list of technologies and engineering teams Silicon Labs absorbed over the last few years is impressive. They include the acquisition of Ember, a leading provider of ZigBee SoC devices and software in 2012, and the acquisition of Oslo-based Energy Micro, provider of the EFM32 Gecko MCU family of low-energy devices, in 2013. Silicon Labs in 2015 bought Finland-based Bluegiga, a provider of Bluetooth Low Energy solutions, and U.K.-based Telegesis, a provider of Zigbee modules. In 2016, it added the leading RTOS company, Micrium. Finally, this year, it acquired Wi-Fi innovator Zentri.

Ember brought much needed software prowess, while Energy Micro with the Gecko MCU family has been a star. The Micrium acquisition has also been critical, Tuttle said, “because IoT needs a lightweight, small footprint RTOS for energy constrained applications.”

Asked why Silicon Labs had to buy an RTOS company instead of licensing a third-party OS, Tuttle said, “In order to optimize RTOS for your hardware solution, you need the OS. Further, to do that optimization, you need software engineers to do it.”

Describing Micrium as “a very clean RTOS,” Tuttle said that he saw Micrium’s engineering talent crucial to delving more deeply into hardware that could optimize RTOS.

Silicon Labs has also spent time adding security to IoT SoCs. The company’s focus is to enabling secure elements in devices in a manner that is optimal in both cost and energy.

“Our goal is to take hardware security to the next level,” said Tuttle. This includes adding security acceleration hardware encryption blocks onto IoT SoCs, explained Tuttle.

The key is to develop solutions that entice system designers to add security without wasting time (for running security) or energy (consuming too much power).

IoT revenue?

Silicon Labs is beginning to reap the fruits of its earlier IoT investment. Last year, 45 percent of its $698 million in revenue came from IoT-related products. In this year’s first quarter, Silicon Labs reported an IoT revenue increase to $88 million, up 24 percent compared to a year ago.

Contact Symmetry Electronics at 866-506-8829, email us or start a live chat and we'll be glad to help you with your projects!